Introduction

Quotex Trade has become a recognizable name among online trading platforms that offer simplified digital-asset and options-style instruments to retail traders. This article breaks down the essentials so a reader can understand what the platform aims to provide, how the interface and core tools typically behave, and what realistic expectations to hold before depositing funds. The goal is not to promote or disparage but to present balanced, actionable information aligned with good editorial standards: clarity, evidence-awareness, and transparent risk warnings. Throughout, I’ll emphasize verifiable behaviors how accounts are commonly opened, what features are frequently highlighted by platforms like Quotex, and the kinds of protections and limitations traders should research. If you’re researching online trading platforms, treat this article as a primer: it should help you ask the right questions of regulators, payment processors, and customer support, and it should make you more discerning when comparing platforms. Always remember: trading carries risk, past performance is not a predictor of future results, and using demo accounts and careful small-scale testing is a wise first step.

What is Quotex Trade?

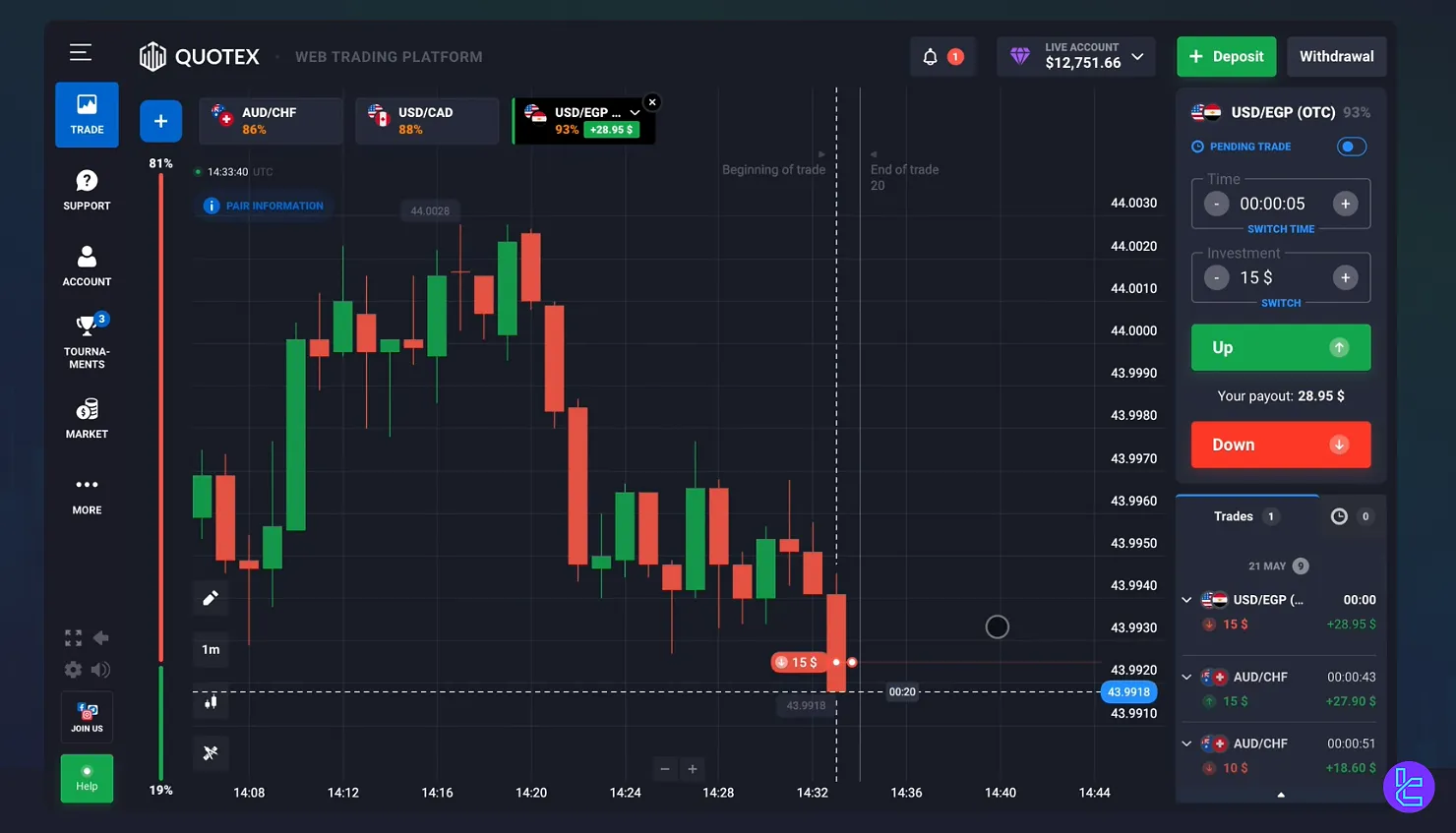

Quotex Trade is typically presented as an online trading platform that offers digital contracts or derivative-like products with short- to medium-term expiry structures. These products let traders make directional decisions (for example, a bet that a price will be higher or lower at a defined time) and are often wrapped in an interface designed to make entry and exit straightforward. Platforms of this type emphasize ease-of-use: simplified charts, one-click trade entry, preset expiry times, and demo accounts so new users can practice without real capital. Important to understand is that the mechanics differ from traditional stock investing or long-term CFDs many digital-style instruments behave more like binary or fixed-return contracts, with payoff profiles that can be all-or-nothing or offer asymmetric returns based on outcome. That means outcomes are binary by design, and risk management requires special attention. Readers should verify license status, jurisdiction, and the exact nature of the product offered (binary vs. CFD vs. other derivative) before committing funds.

Key Features and platform overview

Platforms branded like Quotex commonly highlight several core features: an intuitive web or mobile interface, real-time charts, a demo account, multiple asset classes (forex pairs, commodities, indices, and some cryptocurrencies), and preset trade amounts and timeframes for ease of use. You’ll often find charting options (candlesticks, timeframes), technical indicators, and tools for trade history and performance tracking. Customer support channel live chat, email, or knowledge bases are usually marketed as part of the user experience. Payment flexibility (cards, e-wallets, cryptocurrencies) is frequently emphasized, as well as promotional bonuses or educational resources to onboard new traders. However, marketing materials can gloss over regulatory nuance and payout math; therefore it’s important to read the fine print about fees, withdrawal times, account verification requirements, and any promotional conditions. Verified user reviews and third-party regulatory listings help build a more complete picture of service reliability, dispute resolution paths, and how the platform handles withdrawals and account security.

How to start trading on Quotex

Getting started on any online trading platform generally follows a sequence: create an account, verify identity where required, fund a live account (or start with a demo), learn the interface, and place small initial trades while tracking outcomes. A typical checklist includes: confirm regulatory jurisdiction and license information; read terms of service for deposit/withdrawal policies; use the demo account to practice; choose asset classes you understand; set a clear trade size relative to your risk budget (never risk more than you can afford to lose); and test withdrawal to confirm payment processing speed. Many platforms require ID verification for withdrawals plan for that step before relying on the account for funds. Keep records: take screenshots of balances, trade confirmations, and communication with support. If you decide to scale up, do so gradually and document why each increase is justified. Finally, maintain a strong skepticism of promotional claims of “guaranteed profits” or pressure to deposit more responsible platforms encourage informed, controlled trading rather than high-pressure upsell tactics.

Risk management and best practices

Trading digital contract products or short-term derivative-like instruments demands strict risk management because outcomes can be fast and absolute. Key practices include position sizing (risk a small, fixed percentage of capital per trade), using a demo account before live trading, and keeping a trading journal to track rationale and outcomes. Diversify exposure across asset types and timeframes rather than concentrating all funds in one short-duration bet. Set withdrawal and profit-taking rules decide in advance what portion of gains you’ll secure off-platform. Be vigilant about leverage, if present, and understand how margin calls or forced liquidations operate. Also consider cybersecurity best practices: enable two-factor authentication, use strong unique passwords, and ensure your device and network are secure. When evaluating platforms, check for transparent dispute procedures and whether funds are held in segregated accounts or pooled. Finally, consult independent, reputable sources and, if necessary, seek advice from licensed financial professionals; this content is informational and not investment advice.

Conclusion

Quotex Trade and similar platforms offer an accessible entry point to online trading, emphasizing simplicity and quick trade cycles for users attracted to active decision-making. That accessibility brings both opportunity and elevated risk: simplified entry does not reduce complexity or the need for discipline. Before committing real funds, verify regulatory and legal standing, practice on demo accounts, and adopt strict risk-management rules. Treat promotions and high-return claims skeptically, and document every step you take verification, deposits, trades, and withdrawals to make any future disputes easier to resolve. If you remain curious after reading this primer, your next sensible steps are to compare regulatory listings, test the demo thoroughly, and possibly consult an independent, licensed financial professional for personalized guidance. Knowledge, patience, and careful verification are the best tools for anyone exploring platforms like Quotex Trade.

FAQs

- Is Quotex Trade regulated?

Regulation varies by provider and jurisdiction. Always verify the platform’s current licensing information on official regulatory websites before funding an account. - Can I start with a demo account?

Most platforms offer demo accounts. Use these extensively to learn the interface and test strategies without risking capital. - What payment methods are typically supported?

Common options include credit/debit cards, e-wallets, and sometimes cryptocurrencies; withdrawal processing times and fees differ, so read the terms. - Are there withdrawal limits or conditions?

Many platforms require identity verification before withdrawals and may impose processing windows or minimums check the terms carefully. - Is trading on such platforms the same as investing in stocks?

No. Short-term digital contracts and derivative-like instruments have different payoff profiles, risk structures, and regulatory treatments compared with long-term stock investing.